ABN AMRO insurances

With minimal adjustments improve the customer journey and increase the customer satisfaction.

Did you know that the Netherlands is the most insured country in Europe? In the Netherlands it is quite normal to take out multiple insurance policies. ABN AMRO wanted to make it a friction free experience.

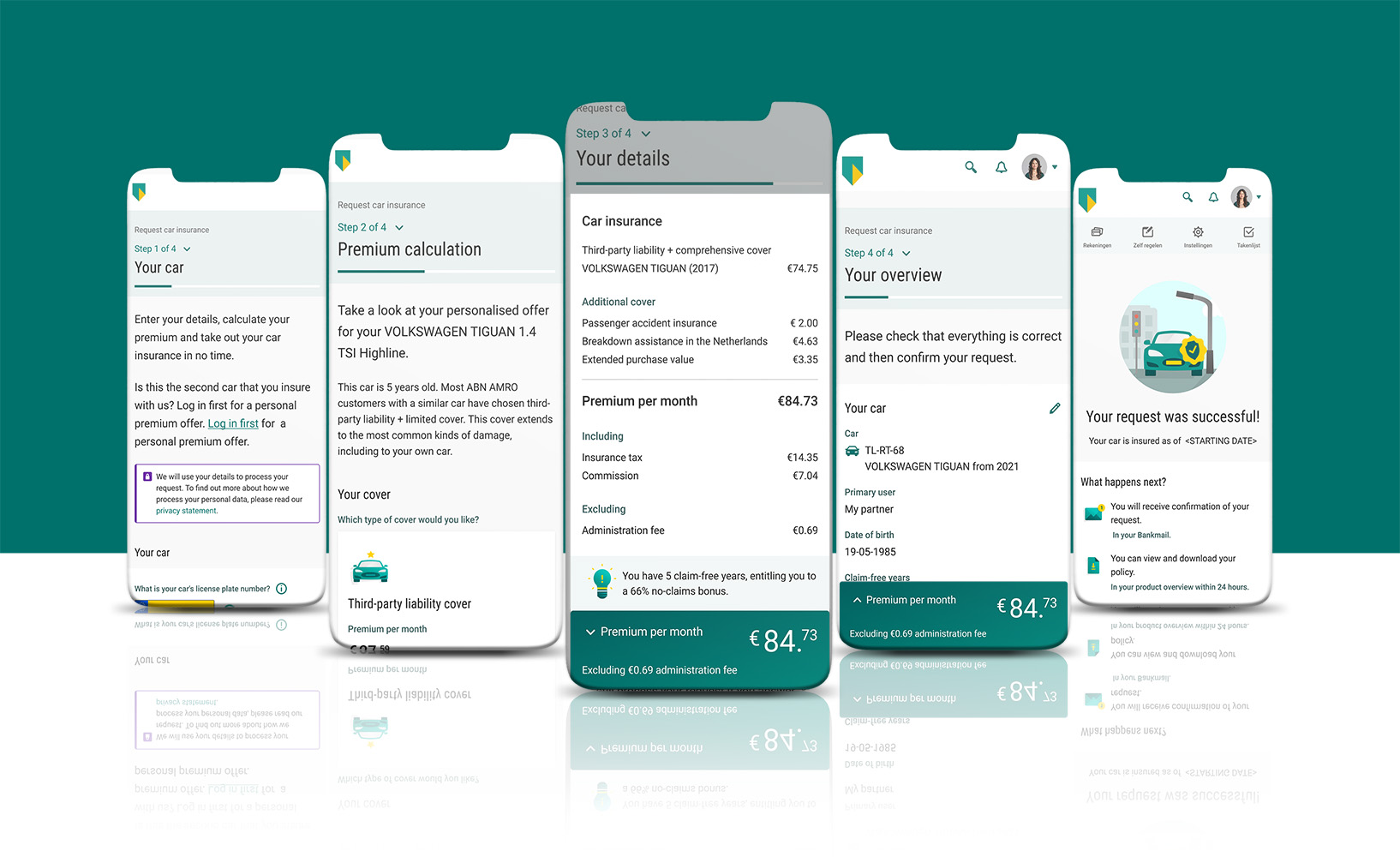

Request

With the implementation of a new insurances backend system, the ABN AMRO needed to rebuild the complete frontend of the request and read flows. A change to improve the customer satisfaction and implement the design system in the flows.

Reduce friction applying for a second car insurance

Because of the limited time, no big changes could be made. The challenge was to look where small UX improvements could be made to improve conversion of the request insurances flows.

One of the challenges was to reduce the friction applying for a second car insurance. This was a separate flow with a separate entry point. This was confusing the customer and resulted in the need for the customer to start all over when entering the wrong flow at the start of the request. Also replacing an insured car wasn’t possible online.

My role

As the UX designer I primarily worked on UX and UI design, on user testing and interviews and contributed to the design system.

Activities

Data analysis

Discover churn points by teaming up with eCommerce department.

UX/UI design

Created responsive and detailed designs for the development team.

Visual design

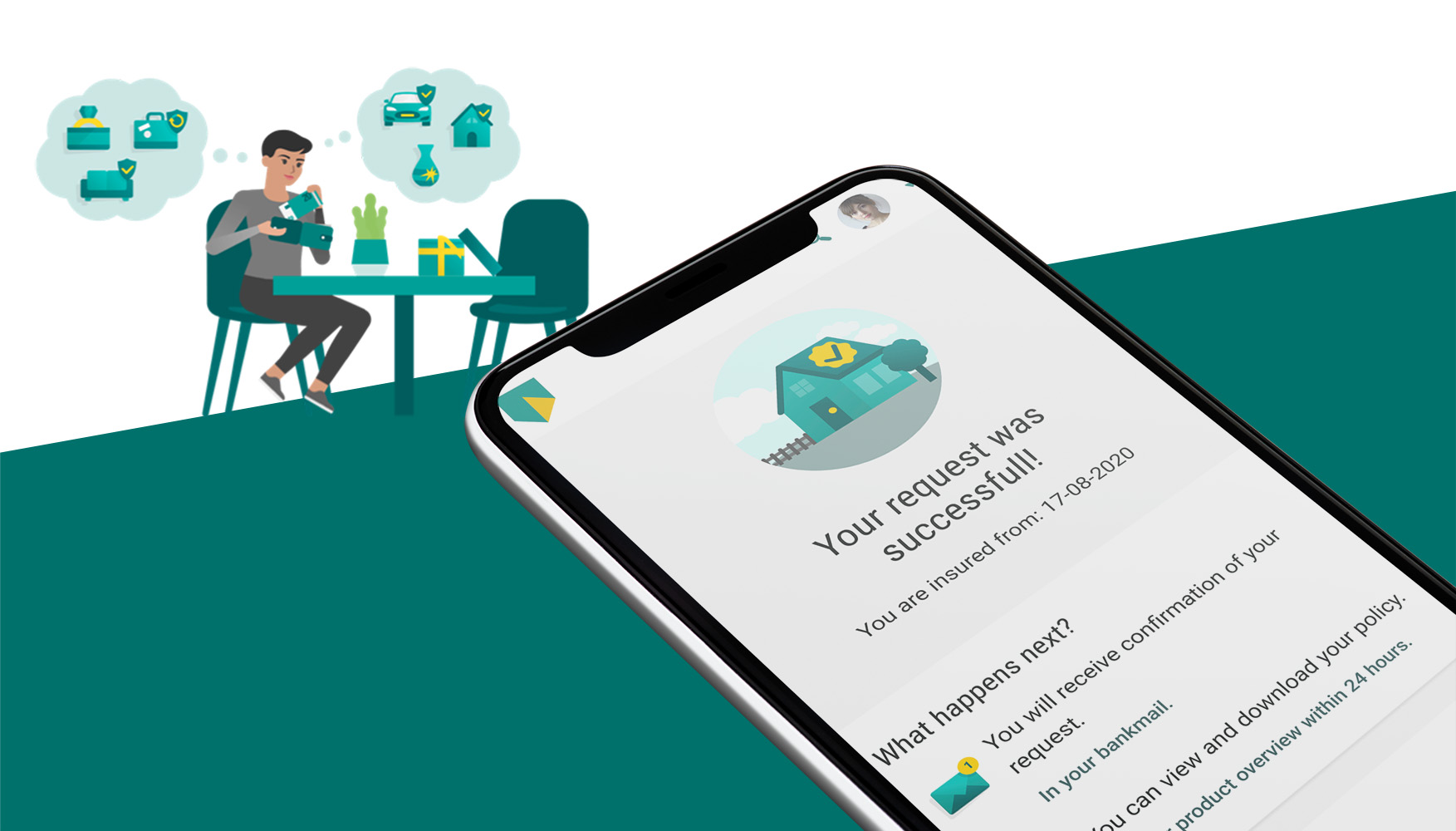

Create animations for the confirmation screens.

Prototyping

A clickable prototype was created for the user test. It also provided great insights to the stakeholders.

Journey Map

Define how the different types of users use the application flows. With all the choices and dependencies when applying for insurance, journey mapping was essential to provide all parties with a clear picture of what functionalities and variations were possible.

Ideation & Validation

Test prototypes with users in UX lab, improve and come back. User tests provided great insights into the information customers needed and interpreted to have a seamless experience in calculating the premium and request for an insurance.

Creating user stories

In Jira (later on Azure boards) adding the functional description and acceptance criteria for development. Preparing functional documentation in confluence with detailed functional descriptions and copy.

Design check

Checked the implemented design and tested the functionalities in the test, acceptance and production environment.

Outcome

The conversion rate of customers who were logged in at the start of the request was higher compared to people who first calculated the premium and then logged in. When a customer started the flow logged in there was another advantage. We could ask less questions and provide the correct information.

The number of customers logging in at the start of the flow increased and with that the conversion rate

To encourage customers to log in, we tested several options to promote this option. The outcome of this user research was that customers feel compelled to log in with a prominent login button. By explaining the advantages of logging in and placing the button less prominently, customers did not feel pressured. The number of customers logging in at the start of the flow increased and with that the conversion rate.

By combining the first and second car insurance flow, the customer had only one entry point for requesting a car insurance. This avoided confusion and the need to start over. There was another advantage by checking the customer data we could give the user feedback about the data and prevented incorrect requests. This improved customer satisfaction and reduced the time advisers checking requests manually

Launch

This project leaded to a successful launch of the request and read flows for the Car insurance, Liability insurance, Legal assistance insurance, Annual travel and Short-term travel insurance and the combined home insurances tool.

[ STEPS & COUPON]

[ ANIMATIONS SUCCES SCREEN ]

Contact

+31 6 19 54 80 65

sandra@ridderfactory.nl

Copyright Sandra de Ridder · 2024